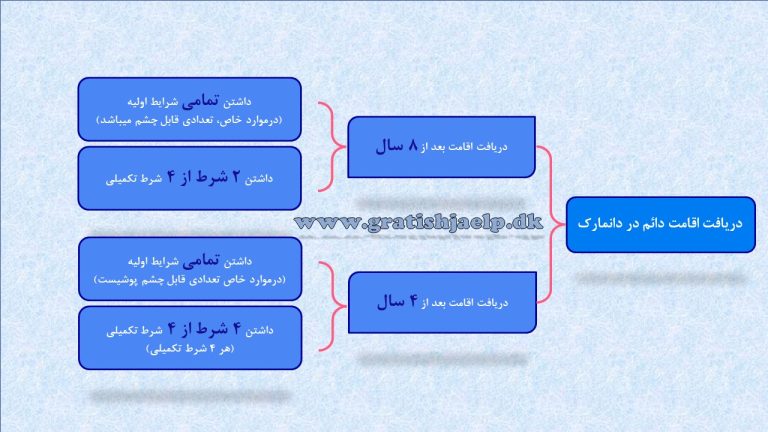

When you have a temporary residence permit in Denmark for at least 8 years , you can get a permanent Danish residence permit.

In some cases, at least 4 years, you have to meet some conditions.

More relaxed conditions for permanent residence apply if:

A young person between 18 and 19 years old who has been studying or working continuously since finishing primary education.

Read more about 18-19 year olds

A person of Danish descent, previous Danish citizenship or connection to the Danish minority.

What conditions are required?

Preliminary conditions

Preliminary conditions

1. You must be over 18 years old

You must be over 18 years old to get a permanent residence permit.

2. You must still meet the requirements of your current residence permit

You must continue to fulfill the continuing conditions set for your current residence permit.

You should also note that when the Danish Immigration Service makes a decision about you, having a residence in Denmark is a necessary condition for obtaining a permanent residence permit.

If you are applying for permanent residence as a married couple, your spouse in Denmark must also meet certain current conditions for your residence permit and fill out part of the application.

3. You must have lived legally in Denmark for at least 8 years.

4. You must not have committed certain types of crimes

You must continue to fulfil the continuing conditions set for your current residence permit.

You should also note that when the Danish Immigration Service makes a decision about you, having a residence in Denmark is a necessary condition for obtaining a permanent residence permit.

If you are applying for permanent residence as a married couple, your spouse in Denmark must also meet certain current conditions for your residence permit and fill out part of the application.

5. You must not have outstanding debt to the public sector

You must not have outstanding debt to the public sector. The debt becomes due when the period during which the public is entitled to pay the debt or part of it has passed.

The following types of debts are considered as debts to people that you should not have if you want to get a permanent residence permit (the list is complete):

- Benefits subject to repayment under the Social Services Act or the Active Social Policy Act (such as overpaid cash assistance).

- Child allowance is paid in advance.

- Kindergarten payment

- Reimbursement of overpaid housing facilities.

- Subsidized housing loan repayment.

- Taxes and duties, unless the outstanding taxes or duties are due to circumstances beyond your control.

Other debts, such as student loans or debts owed to banks or credit unions, are not the types of debt that will disqualify you from receiving permanent residency.

deferment

If the debt is forgiven, you can still get a permanent residence permit. However, the condition is that the debt does not exceed 128,081.63 kroner (2023 level).

Deferment means that the creditor (government sector) allows the debtor (you) to wait until later than the original due date to pay the debt. For example, you can get a deferment by paying a debt to SKAT.

In case of doubt, the municipality, SKAT or Udbetaling Danmark can inform you whether a grace period has been granted with the debt.

Installment plan

If you have outstanding debt to the public sector, you will not be able to get a permanent residence permit, regardless of whether an installment plan has been agreed.

The installment plan means that instead of paying your debt all at once, you pay your debt in installments according to the agreement with the government authorities. For example, you pay SEK 500 per month for 3 years.

If you succeed in repaying the debt

If you have an outstanding debt to the public sector and after applying, you have succeeded in repaying all of your debt, but before the Danish Immigration Service decides on this, you must provide documents showing that you no longer owe the public sector. .

6. You must not have received public assistance under the Assets Act or the Consolidation Act

You must not have received certain types of public assistance in the last 4 years before the application and until the decision on the permanent residence permit.

The determining factor in assessing whether you have received state assistance is whether the benefits received were paid in accordance with the Act on Active Social Policy (Act on Active Social Policy) or the Act on Integration (Act on the Integration of Foreigners). in Denmark). If you have received benefits under one of these rules, you can usually only get a permanent residence permit after 4 years have passed since you received the most recent benefits.

Example: If you received cash assistance by July 1, 2014, you will first meet the condition of not receiving government assistance on July 1, 2018.

However, there are certain benefits that do not prevent you from obtaining a permanent residence permit.

Read more about which services to see if you can get a permanent residence permit

Especially in the case of supplementary cash assistance

If your spouse has received cash assistance for a period, you may have received top-up cash assistance during the same period. Therefore, you need to know whether your spouse has received cash assistance in the last 4 years before the time of application or during the processing of the case.

If so, it may mean that you received top-up cash assistance in the same period. This can lead to your permanent residence permit being rejected for this reason. If you are in doubt whether you have received additional cash assistance or not, you can contact your municipality.

7. You must accept the declaration of residence and self-sufficiency

You must accept the Declaration of Residence and Self-Sufficiency. This declaration is included in the digital application solution and in the application forms.

8. You have to keep working

You must be at your workplace when the Danish Immigration Service makes a decision on the case.

You are eligible to continue working if, at the time of decision on permanent residence permit, you:

- An employee is in an open position that has not been terminated;

- can prove in another way that you expect to be employed in the future, for example if you are an employee in a permanent position where a certain part of the employment period still remains, or

- is self-employed

Example: If you are employed in a certain position that is about to expire, you can prove that you will continue to work, for example by attaching a new employment contract or a statement from the employer that your employment is expected to be renewed.

It is not a requirement that your current job be a full-time job, if the basic job requirements are otherwise. However, you must work at least 15 hours per week.

Read more about basic working conditions

If at the time of the decision on the permanent residence permit, you do not have the conditions to continue working:

- is employed in a job with a wage subsidy,

- is in unpaid work,

- are under training, including in an internship or other work that is part of training;

- Works as a temp in a temporary agency

- Work less than 15 hours per week,

- works for a company that is in liquidation, compulsory liquidation, suspension of payments or bankruptcy, or

- Is a self-employed trader who is in liquidation, compulsory liquidation, has given notice of suspension of payments or is in bankruptcy.

9. You must not have actively objected to the clarification of your identity

You must not have actively objected to the clarification of your identity in connection with your application for a residence permit or extension of your residence permit.

This condition applies if you submitted your first residence permit application on or after January 1, 2018.

For example, if you have provided false identification, such as a passport or birth certificate, or have provided someone else’s identification, you may be considered to have actively objected to the disclosure of your identity.

This may also be the case if you have misrepresented your name, date of birth, country of birth or citizenship and these are clarified later in the case by you or the immigration authorities through control questions. , experiments, research, etc

If there are very specific reasons for it, you can get a permanent residence permit, even if you objected to clarifying your identity.

10. You must have passed Danish test 2

You must have passed the Danish language test 2 or the Danish test at an equivalent level or higher.

See a list of Danish exams at a level similar to or higher than Prøve i Dansk 2

Additional requirements in the Danish language exam 3

If you have passed the Danish language test 3 or the Danish test at the same level or higher, you can fulfill one of the 4 additional requirements.

Read more about the additional requirements and see the list of Danish exams that have a level similar to or higher than Prøve i Dansk 3 below.

11. You must have been at work for at least 3 years and 6 months

You must have been in normal full-time work or self-employment in Denmark for at least 3 years and 6 months in the last 4 years before the decision on a permanent residence permit was made.

That is, in the last 4 years, you must have been in a job for 3 years and 6 months to be included in the calculation.

You do not have to have worked for 3 years and 6 months in a row. This condition can be met, for example, if you have been in full-time work for 1 year, then unemployed for 6 months and subsequently in full-time work for 2 years and 6 months.

what is a typical full-time job?

Regular work means that the work must be free of government subsidies, such as wage subsidies. In addition, the work must be remunerated under an applicable collective agreement or performed under customary wage and working conditions.

Full-time work is work with the average working time in this country of at least 30 hours per week, equivalent to at least 120 hours per month.

If you have worked in several places at the same time, you qualify for regular full-time work if the total weekly working time is at least 30 hours, equivalent to at least 120 hours per month.

The following are included as normal work:

- Paid work with a weekly working time of at least 30 hours, equivalent to at least 120 hours per month.

- Be self-employed if the work is of a scope that can be considered equivalent to full-time paid work.

- Work as a supporting spouse in self-employment if the work is taxable and of a scope that is equivalent to full-time salaried work.

- Periods of absence due to illness, holidays, care and maternity days, etc. within the framework of the employment relationship.

- Flexijob, according to the rules of the Active Employment Efforts Act, regardless of whether the employer receives a public subsidy or not. Flex jobs count as full-time work regardless of the actual number of hours.

The following are not considered normal tasks:

- Periods of unemployment provision (also unemployment provision).

- Unpaid work.

- Work with a wage subsidy.

- Hiring in job rotation.

- Training, including internships or other work that is part of training.

- Work periods of less than 30 hours per week.

Read more about what can count as regular full-time work when applying for permanent residence

additional condition of working for at least 4 years

If you have been employed for at least 4 years in the last 4 years and 6 months, you can meet one of 4 additional requirements.

additional conditions

Additional conditions

1. You must have passed the Danish test 3.

If you have passed the Danish language test 3 or the Danish test at the same level or higher, you can fulfill one of the 4 additional requirements.

See a list of Danish exams at a level similar to or higher than Prøve i Dansk 3

The tests in the list are all at a higher level than Test in Danish 2. If you have successfully passed one of the tests in the list, it means that in addition to having one of the supplementary requirements, you also have the primary requirement. Passing the Danish Language Test 2 or the Danish test at an equivalent level or higher.

2. You must have been working for at least 4 years.

If you have been in normal full-time work or self-employment for at least 4 years in the last 4 years and 6 months before the decision on your permanent residence permit in Denmark, you can fulfill one of the 4 additional conditions. built.

That is, in the last 4 years and 6 months, you must have been in a job for 4 years to be included in the calculation. You don’t have to have worked for 4 consecutive years. This condition can be met, for example, if you have been in full-time work for 2 years, then unemployed for 6 months and subsequently in full-time work for 2 years.

Read more about what normal full-time work is and what can be included in the calculation

3. You must have passed a citizenship test or demonstrated active citizenship

If you have passed the citizenship test or have demonstrated active citizenship in Denmark by participating in boards, organizations, etc. for at least 1 year, you can meet one of the 4 additional requirements.

Citizenship test

The citizenship test is a written test that is held twice a year in June and December. This test is held by a number of language schools across the country.

The current citizenship test has been held since 2016. A previously passed citizenship test from before 2016 cannot satisfy the additional citizenship requirements.

The passed citizenship test also cannot meet the additional requirements of citizenship.

Registration and examination

On the website integrationsviden.dk you can read about how to register for the citizenship test and about the test itself. You can also see the next exam date and registration deadline.

Read about registration and exam

Preparation for the exam

The citizenship test is designed as a multiple-choice test and contains 25 questions about the Danish government and everyday life, as well as about Danish culture and history.

The course material is prepared so that you can prepare for the exam. The test questions are based on these materials.

Find educational materials for the citizenship test

Active citizenship

If you can show proof of active citizenship in Denmark through at least 1 year of membership in a board or organization, etc., you can also meet additional citizenship requirements. It is a requirement that these are boards, organizations, etc. that support in speech and action the basic democratic values and legal principles in Danish society.

It is not required that you have participated in an organization or board etc. For 1 year continuously this means you can achieve 1 year of active citizenship over several years. It is also not required that you continue to participate in the organization or the board of directors at the time of the decision on the permanent residence permit. Finally, it is not necessary to be a member of the same organization or board of directors etc. Through 1 year

Membership in the board of parents, school board, non-profit housing organization board, integration council or senior citizens council

For example, you qualify for active citizenship if you have been an active member of a parent council, school board, board of directors of a non-profit housing organization, integration council or senior citizen council for at least one year. .

You can register active membership of the parent board by attaching a statement from the kindergarten, municipal kindergarten, leisure center or club, which shows what role you played in the parent board and how often you participated. Board meetings and/or other activities organized by the parent board.

Active membership on a school board or board of a non-profit housing organization can be documented by attaching a statement from the school or housing organization showing what role you have played on the school board and how often you have served on it. . Board meetings and/or other activities conducted by the school board.

Active membership in an amalgamation council or aldermen’s council can be documented by attaching a statement from the municipal council that created the council showing what role you played in the amalgamation council or aldermen’s council and how often. You have participated in council meetings and/or other activities organized by the council.

Participation in the work of children or teenagers

You will also fulfill the active citizenship requirement if you have been involved in working with children or young people for at least 1 year, for example as a coach in a sports association or by completing a refereeing or coaching training course. The same applies to participation in one or more university stays with a total duration of at least 1 year, sample work or participation in other organized leisure activities for children and young people, such as homework help.

You can document this by attaching a statement from the association or organization, etc., in which you have been involved, which describes your role and activities in the association or organization, by attaching completed documentation of refereeing training or coaching. . including for the duration of the training course as well as your activities as a trainer after the training, or by attaching the documents of participation in a university course, including its duration.

Participation in the work of non-profit organizations

Also, if you have participated in the work of a non-profit organization for at least 1 year, for example, if you have actively participated in the activity of an association, you will also meet the condition of active citizenship. For example, non-profit associations can be associations that are eligible for subsidies under the Norwegian Public Information Act.

If you have a residence permit based on work or as a missionary, you should be aware that volunteer work may require a separate permit in addition to your current temporary residence permit.

4. You must have an average annual income above a certain amount

If you have an average annual taxable income of DKK 309,824.37 (2023 level) or more in the last 2 years before deciding on a permanent residence permit, you can meet one of 4 additional conditions.

The following types of taxable income are included in the calculation of whether your annual taxable income was an average of SEK 319,738.75 (2024 level) or more:

- An income

- B income

- Salaries paid daily, including food and accommodation

- Contribution to occupational pension

- Salaries paid abroad, if taxable in Denmark.

In order to be able to assess whether you qualify to have an average annual income above a certain amount, you must attach documents of your income status for the last 2 years. Sufficient documents can be, for example, annual statements and payslips. If you are self-employed, the documentation could be a statement from your accountant showing the company’s basic turnover information.

Foreign income

If you have earned income that is taxable in Denmark, the income is included in the calculation in relation to posting or posting abroad.

If you are taxable in Denmark, but work abroad for a period of time and pay tax there, your income paid abroad can be included if SKAT assesses that the income would have been earned if the work had been done in this country. It was taxed in Denmark. this country.

In relation to the stay abroad, the income paid on a daily basis, including the cost of food and accommodation, may also be included in the calculation.

If you have earned income abroad in the last two years before deciding on a permanent residence permit, you must receive a declaration of income from the Danish tax authorities. The declaration must state whether the income would be taxable if the work were done in this country.